UAE Tourism Competitive Analysis 2024

Regional market positioning and competitive intelligence

Comprehensive comparison with GCC and regional tourism destinations

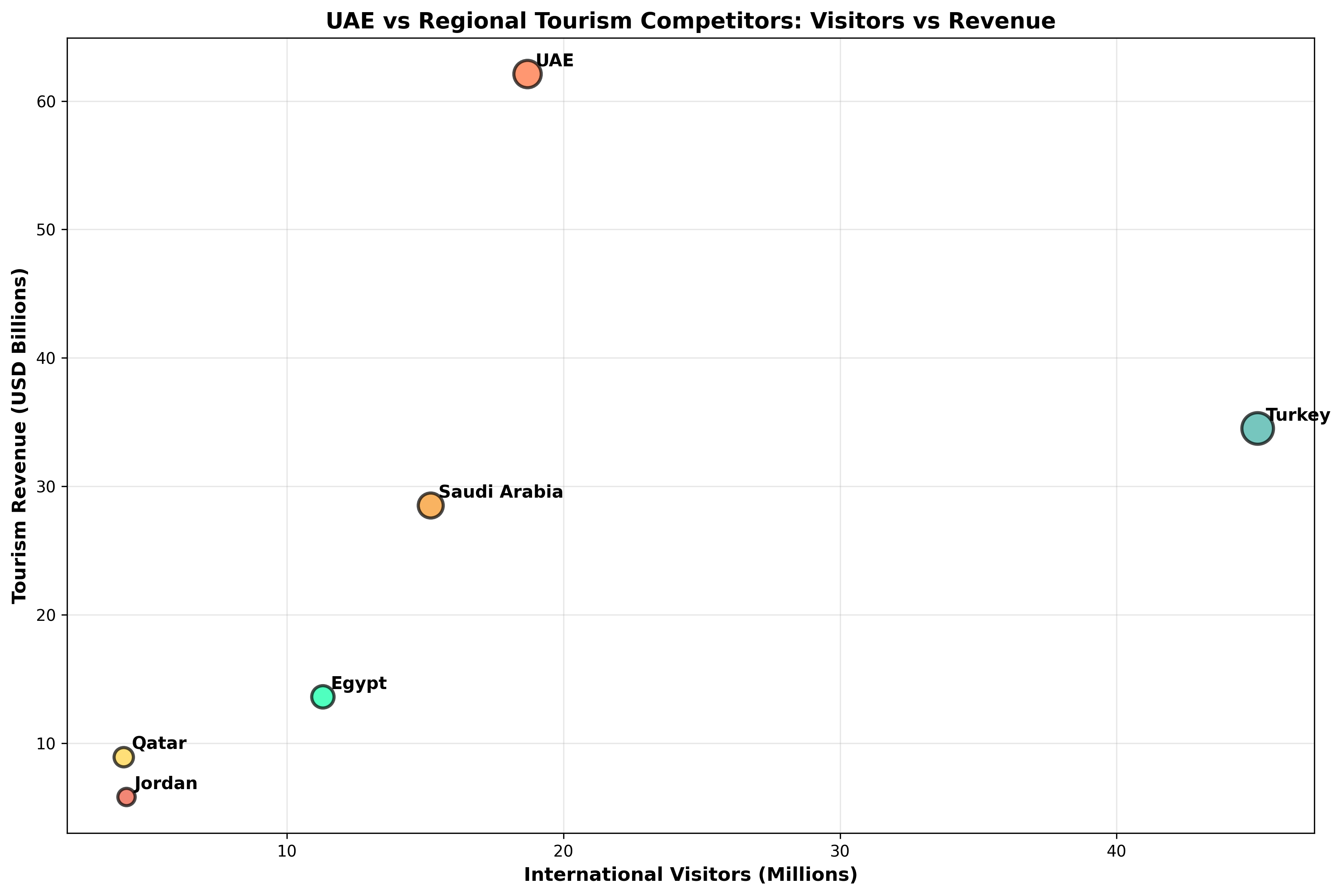

Regional Market Position

UAE's standing among Middle East tourism destinations

Regional Tourism Performance Comparison

Market Rankings

Key Performance Metrics Comparison

Head-to-head comparison across critical tourism indicators

| Country | Annual Visitors | Tourism Revenue | GDP Contribution | Avg Stay (Days) | Visa Processing | Satisfaction |

|---|---|---|---|---|---|---|

| 🇦🇪 UAE Market Leader | 18.72M +15.2% | AED 198.4B +12.8% | 13.4% +0.8% | 7.2 +5.9% | 24.6 hrs -15.3% | 4.8/5 +0.3 |

| 🇸🇦 Saudi Arabia Strong Competitor | 15.3M +22.1% | SAR 145.2B +18.5% | 9.2% +1.2% | 6.8 +3.2% | 48.2 hrs +2.1% | 4.3/5 +0.2 |

| 🇶🇦 Qatar Growing Market | 4.2M +8.7% | QAR 28.5B +6.3% | 5.8% +0.5% | 5.9 +2.1% | 36.4 hrs -8.2% | 4.5/5 +0.1 |

| 🇧🇭 Bahrain Stable Market | 3.8M +4.2% | BHD 1.8B +3.1% | 7.1% 0.0% | 4.2 +1.8% | 42.1 hrs -5.3% | 4.2/5 0.0 |

| 🇴🇲 Oman Emerging Market | 2.9M +12.5% | OMR 2.1B +9.8% | 6.3% +0.7% | 8.1 +4.3% | 52.8 hrs -12.1% | 4.4/5 +0.2 |

UAE Competitive Advantages

Key differentiators driving UAE's market leadership

World-Class Infrastructure

State-of-the-art airports, hotels, and transportation systems providing seamless visitor experience.

Fastest Visa Processing

Industry-leading 24.6-hour average processing time with 97.8% approval rate.

Diverse Attractions

Unique blend of modern marvels, cultural heritage, and luxury experiences.

Regional Market Share Analysis

UAE's dominance in the GCC tourism market

GCC Tourism Market Share 2024

Market Insights

Market Leadership

UAE maintains 42.3% market share, significantly ahead of nearest competitor Saudi Arabia at 34.6%.

Growth Trajectory

UAE's market share increased by 2.1% in 2024, strengthening its regional dominance.

Competitive Gap

7.7% gap with Saudi Arabia provides comfortable market leadership position.

Future Outlook

Projected to reach 45% market share by 2025 with continued infrastructure investments.

Strategic Recommendations

Maintaining competitive advantage in the evolving market

Maintain Leadership

- Continue Infrastructure Investment: Maintain world-class facilities and expand capacity

- Enhance Digital Experience: Further streamline visa processing and digital services

- Diversify Attractions: Develop new unique experiences and cultural offerings

- Strengthen Marketing: Increase global brand presence and awareness campaigns

Competitive Defense

- Monitor Saudi Growth: Track Vision 2030 initiatives and respond strategically

- Price Competitiveness: Maintain competitive visa pricing and value propositions

- Service Excellence: Continue improving customer satisfaction and service quality

- Innovation Leadership: Pioneer new tourism technologies and experiences